Palo Alto Networks on Monday reported better-than-expected fourth-quarter financial results, highlighting "notable strength in large customer transactions."

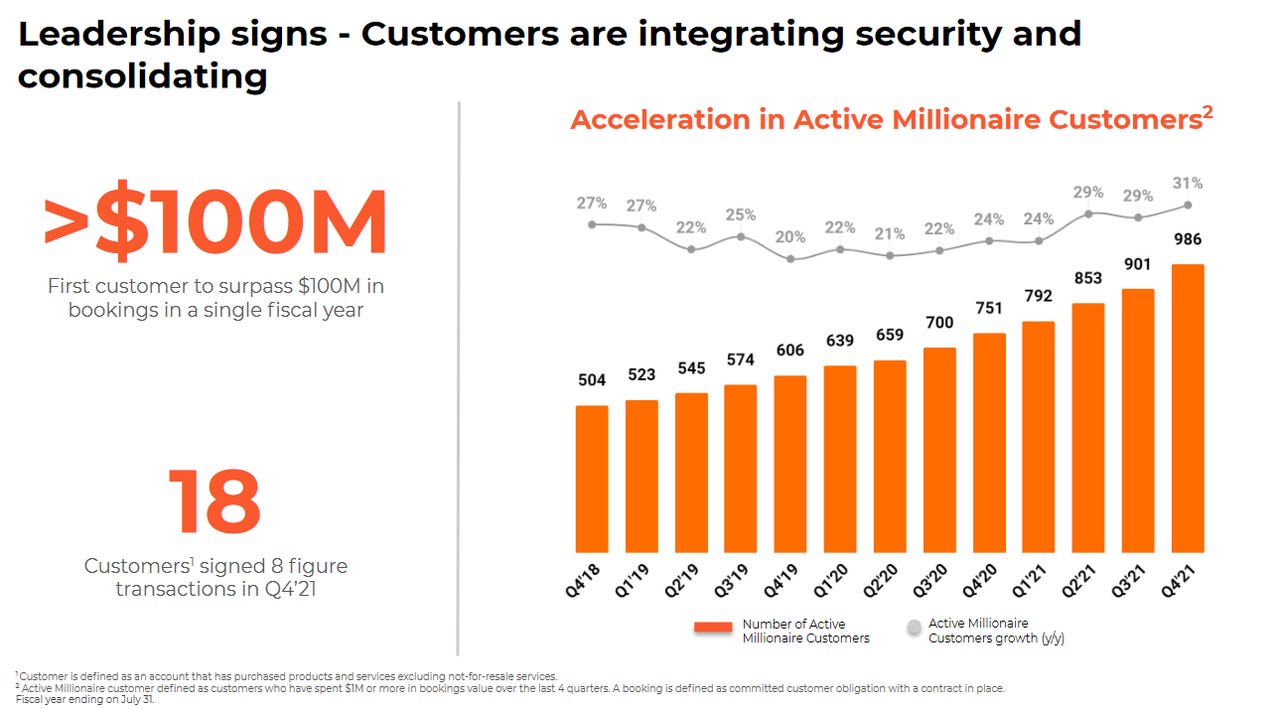

As many as 18 customers signed 8-figure transactions in Q4, the company said.

Palo Alto Networks

Palo Alto Networks

Non-GAAP net income for the fourth quarter was $161.9 million, or $1.60 per diluted share. Fourth-quarter revenue grew 28% year-over-year to $1.2 billion.

Analysts were expecting earnings of $1.43 per share on revenue of $1.17 billion.

For the full fiscal year 2021, revenue grew 25% to $4.3 billion.

"Our strong Q4 performance was the culmination of executing on our strategy throughout the year, including product innovation, platform integration, business model transformation and investments in our go-to-market organization," chairman and CEO Nikesh Arora said in a statement. "In particular, we saw notable strength in large customer transactions with strategic commitments across our Strata, Prisma and Cortex platforms."

Fourth-quarter billings grew 34% year-over-year to $1.9 billion. The fiscal year 2021 billings grew 27% to $5.5 billion.

Deferred revenue grew 32% year-over-year to $5 billion, while remaining performance obligation (RPO) grew 36% to $5.9 billion.

For Q1 2022, Palo Alto expects revenue in the range of $1.19 billion to $1.21 billion.

Analysts are expecting revenue of $1.15 billion.

For the fiscal year 2022, the company expects revenue in the range of $5.275 billion to $5.325 billion.

Tech Earnings

-

SMART Global fiscal Q2 results, outlook top expectations

-

Adobe shares sag as outlook misses expectations

-

Micron stock jumps as fiscal Q2 results, outlook top expectations

-

Oracle shares rebound, fiscal Q4 view tops expectations

-

PagerDuty stock surges as fiscal Q4 revenue, forecast top expectations

-

DocuSign shares plunge, Q1 and year views miss expectations

-

Crowdstrike reports Q4 revenue of $431 million and $1.45 billion for full year

-

Broadcom shares jump as fiscal Q1 results, outlook top expectations